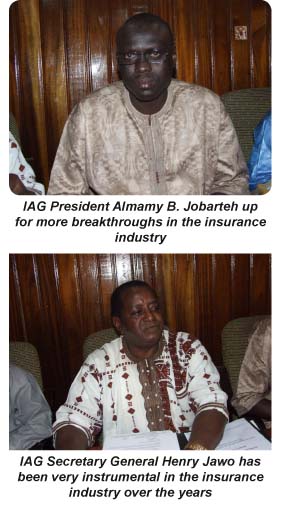

Almamy B. Jobarteh, new president of the Insurance Association of The Gambia (IAG), has expressed strong desire to take Gambian insurance industry to higher heights by bringing to pass most of the resounding plans of the industry that would boost the sector, develop insurers and bring about customer satisfaction.

The industry has grown in membership to 12 companies with the introduction of Enterprise Life Assurance during the year, which is an important development taking into consideration the benefit economies gain from the establishment of new enterprises, the new IAG president said while making a speech reviewing the association’s activities in 2013 and for the years ahead, at the 26th AGM of the IAG held on Saturday at the Paradise Suites Hotel in Kololi.

“Ladies and Gentlemen,” Mr Jobarteh addressed his colleagues and insurance stakeholders, “I mentioned last year during my inauguration speech that my ambition is to see the gradual growth of the industry to enable us tap the fallow fertile areas in the market. “The Executive Committee under my leadership is convinced that one robust way of achieving this goal is to lobby for the establishment of a National Insurance Commission which will be the driving force for the growth of our industry.

“This is a major project for our industry and I wish to call upon each and every one of us to put together all the necessary resources and efforts to ensure the realization of this project.”

Mr Jobarteh’s emphasis on the necessity of a national insurance commission for The Gambia is well understood and in place as the role of an independent insurance commission or regulatory authority is to ensure that insurance companies are able at any moment to fulfill their obligations and that the interest of the policyholders are sufficiently safeguarded.

The pivotal role insurance plays in the socio-economic development of a nation and its potentiality to act as a catalyst for the eradication of poverty and other social ills in society make it vital for an Independent Insurance Commission to be established.

As stated by former Director General of the West African Insurance Institute, Dr Mike Ikupolati, the establishment of the Independent Insurance Commission is necessary to carry out the following functions:

a) Ensure adequate protection of strategic Government assets and other properties

b) Act as adviser to Government on all insurance related matters

c) Liaise with and advise government departments and agencies on all matters relating to insurance either in their domestic dealings or at international levels

d) Protect the policyholders and beneficiaries and their third parties to insurance contracts, and

e) Establish standards for the conduct of insurance business in The Gambia:

Mr Jobarteh continues his remarks: “Another important area which I would like us to look into is the issue of self-regulation and collaboration in our practices, especially in the area of underwriting and claims management.”

He added that a code of conduct has been drafted and already reviewed by the Executive Committee to address these concerns. “I therefore wish to urge this assembly to give it due consideration for adoption,” he said.

In his report at the AGM, the Secretary General of the IAG, Henry Jawo, also highlighted the association’s activities, saying they have made impressive strides in public sensitization through their nsurance forum programme at radio Gambia, which has been revived for 2014; holding of annual Insurance Awareness Week and regular publication of the Insurance Forum magazine.

He also spoke on the industry’s medical insurance scheme, training, national insurance commission: separation of the National Bureau from the IAG, and ECOWAS Brown Car Insurance Scheme.

“We have successfully conducted a training course on ‘Effective Customer Service’ for staff of member companies with Executive Group Limited, an international training consultancy firm based in The Gambia. This course was offered to members free of charge as the costs were fully incurred by the Secretariat. We also intend to run a similar training this year with our training institute WAII,” he said.

On separation of the National Bureau from the IAG, he noted: “In pursuance of the requirement from the Brown Card Protocol that Insurance Associations be separated from the National Bureaux, I am glad to report that the Executive Committee approved the registration of the National Bureau as a Company Limited by Guarantee to give it the requisite legal status to enable the separation become effective in 2014. The separation has been completed with the approval of the Board and we now seek the final approval of this assembly to conclude this matter.”

The IAG secretary general, who will be serving his last term mainly on contract, as he is already in his 13th year at the position, spoke about the ECOWAS Brown Car Insurance Scheme: “The Secretariat at the National Bureau continued to play an important role in the scheme…

“I also wish to inform this meeting that The Gambia National Bureau will host the 1st Zonal meeting of the Scheme from 22nd to 25th April 2014. This meeting will be preceded by an Extra-ordinary General Assembly to enable the scheme to adopt the new Consensus Brown Card for use in all member states participating in the scheme.”