Everyone likes money. I do, but I don’t know if you do not. I was actually moved to prepare this article on what money is owing to a question raised as regards money in a privileged conversation I was part of with some senior friends and colleagues on the current depreciation of the Gambian dalasi against major international trade currencies, such as the dollar, the euro, the pound and the CFA. Much to talk about this issue but let’s talk about money, which is highly needed by all and sundry, and have our day!

I have therefore decided to share with our readers some aspects of money – what money is, qualities of money, and types of money -- within my limited capacity, drawing from authoritative sources.

Money, according to the International Dictionary of Finance, is the means of facilitating the exchange of goods and services and the accumulation of financial wealth, commonly recognizable as banknotes, coins and bank deposits.

The theory of money ascribes to it three functions: (a) a medium of exchange; (b) a unit of value, and (c) a store of wealth.

The wealth of a nation, for example, exists in the goods and services it produces and that money is merely a convenient way of measuring wealth. It therefore serves as a convenient proxy for all goods and services, enabling these to be exchanged more readily than if they were bartered each against the other.

Money may simply be defined or explained as anything that is generally acceptable as a medium of exchange and for settlement of debt.

Types of Money

The commodities serving as money have varied enormously from time to time and from place to place. For example salt, gunpowder, tobacco, shark teeth, elephant trunk and cowries, etc, were used as money in parts of Africa some years ago. Today, all these have somehow changed and we are faced with a new set of money altogether. Here, following, are some of the commonly used types of money, although some may be yet in full use in The Gambia:

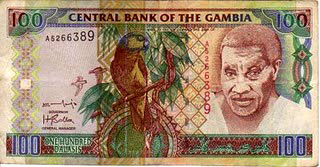

Paper Money: This, as the name indicates, is in the form of paper note (banknote) issued and stamped by the central authority responsible for the issuance of money in a country (e.g. D25, D50, D100, etc). This originated from the receipts the goldsmiths issued to people who kept gold and other valuables with them.

Bank Money: This is the money one keeps in his bank account for safe keeping purpose also known as deposit, which can be given back to the owner on demand.

Coins: A coin is metal money with definite amount and weight issued and stamped by the central authority responsible for the issuance of money in a country (for example, D1, 50b, 25b, etc).

Foreign Money: This is the money of other countries of the world which serves as money in the foreign exchange market. For example, Dollar, Pound Sterling, Euro and CFA.

Commodity Money: Different commodities were used in different parts of the world as medium of exchange and they are presently called commodity money. For example, cowries, shark teeth, salt, tobacco, and gun powder.

Representative Money: These are documents used in lieu of legal tender but not fully and freely acceptable such as cheques, postal order, stamps, promissory notes, and bill of exchange.

Gold-backed money: This is money that can easily be converted or changed into gold by the central authority that issues money, if its holder so desires. This system of exchange paper notes or coins originated from the goldsmiths.

Token Money: This is money whose intrinsic value is less than its nominal value. That is to say, its value as a piece of metal or notes is not identical with its value as a piece of money. For instance, if a coin is made out of pure silver of higher value than its money worth, there is a danger that the silver coin might be illegally melted.

Qualities of Money

Money as is widely known has salient features and value that give it intrinsic qualities different from the ordinary. These qualities and features are what make it known as money or legal tender fit for use within any jurisdiction, which the central authority responsible for the issuance of money in a country approves and endorses.

The qualities of money are as follows, though this list may be inexhaustible, as new features and qualities are determined by the central authorities such as the Central Bank of The Gambia or the Federal Reserve Bank (Fed) of the US.

Acceptability: Money needs to be generally acceptable; commodities were originally used as money because they had intrinsic value to the communities in which they were used.

Portability: Money must be something that can be easily carried about from one place to another without feeling its weight.

Durability: the article/goods that will serve as money must be something that can stand the test of time and not something that will suffer from wear and tear.

Divisibility: The easy business transaction depends largely on this particular quality. Money must be something that can be easily divided into smaller units without loosen its purchasing power; that is, it facilitates exchange of goods and services.

Malleability: This is one main quality of money today that makes it acceptable by the people in the society. Anything that will serve as money must be something that can be stamped and designed to show its value and origin.

Homogeneity: The article used as money must be the same in all parts of the country where it is being accepted as a medium of exchange.

Cheap to maintain: Money has the quality of costing nothing to keep and maintain when compared with commodities used in older days.

Although there is more to it than is put across here, it is hoped this little ration might throw some light to what money is as we continue to make use of it.

BIZFINANCE LEXICON

All risks insurance: Insurance covering a generality of risk (i.e. loss or destruction) rather than one confined to specific perils, i.e. theft or flood.

Bank rate: The interest rate at which the Bank of England lent to the commercial banking system as a lender of last resort. First recognized in 1702, it remained in existence for 270 years, until 1972 when it was replaced by the minimum lending rate.

Minimum Lending rate: The interest rate at which the Bank of England lent to relieve shortages in the money market.

Money market: The market in short-term (normally up to 1 year) financial claims, e.g. bills of exchange, Treasury bills, interbank market and discount house deposits.

National debt: The outstanding borrowings of the government, including overseas borrowing. Most of it consists of government and government-guaranteed securities.

Operating profit (or loss): Profit (or loss) before tax and interest, usually on the principal trading activities of the business and excluding extraordinary items.

Personal loan: A bank loan made without collateral security to a private customer, usually for specific purposes.

Reinsurance: The practice of insurers of passing on part of the risks they assume to other parties in return for a proportional share of the premium income.

Savings bank: A bank that accepts interest bearing deposits of small amounts. The earliest savings banks were established in the private sector, but later they were set up or supported by governments, to encourage individual savings.

Services: That part of the national economy not concerned with the production of tangible goods, i.e. activities such as insurance, transport, banking, securities and commodity dealing, electricity, gas and other utilities, and telecommunications.

Source: The Penguin International Dictionary of Business and Finance