Ecobank Gambia, a subsidiary of the pan-African Bank, has again taken banking in The Gambia a notch higher, with the recent introduction of its new products called Premier Banking and Ecobank Instant Debit Card.

Launched at the Sheraton Hotel on 21 May 2015, the Premier Banking product is a new personalised banking service tailored to meet customers’ financial needs, whilst the Ecobank Instant Debit Card - Platinum Visa Debit – serves as a purchasing tool that is perfect for all payment transactions including online payments.

The bank’s Premier Banking proposition, comprising a suite of world-class solutions, caters to customers’ banking needs ranging from everyday banking to long-term investing.

“Premier Banking rewards you with exclusive and differentiating benefits which also extend to your family, ensuring a total banking relationship for you,” says Ecobank Gambia’s acting head for Domestic Bank, Francis Jatta.

The bank’s world-class Premier Banking products and services include multi-currency Premier current and savings accounts; investment accounts; personal loans; prestigious Ecobank Debit Cards; entitlementto attractivediscounts fromQuantumNET, LG Electronics, R& R Services, Batimat, CFAO Motors Gambia and J Balaji Enterprise; a dedicated Relationship Team; advisory services; Internet and mobile banking services, andaccess to Premier lounges.

Mr Jatta added: “A highly skilled dedicated Relationship Team will be at your service to ensure you receive the level of service and attention you deserve wherever you are, as we build a rewarding and enduring partnership with you.”

Ecobank Visa Platinum

The Ecobank Visa Platinum is a global mark of respect as it is a personalised Platinum Visa Debit Card that is highly secure with Chip & PIN technology.

“The Platinum Visa Debit is the defining purchasing tool for premium cardholders looking to worldwide acceptance, excellent service and access to remarkable benefits,” said Oumie Jobe, Ecobank Gambia’s Relationship Manager.

She added: “Your Visa Platinum card is an internationally accepted card that gives you instant buying power and immediate access to your funds from any part of the world. This card is accepted wherever the Visa logo is displayed, at over 36 million merchant locations and on more than 1.8 million ATMs in over 200 countries.”

The Ecobank Visa Platinum Debit Card, which is “perfect for all payment transactions” including online payments, gives the cardholder a bliss of life as it has benefits of immeasurable value such as its“Lifestyle Flexibility”, permitting aworldwide recognition and acceptance of your Platinum Visa card with the freedom to use it for all kinds of purchases.

The card is also a priority pass, which means it gives you access to over 600 airport lounges around the world at a deeply discounted price of US$27 per visit.

It also has purchase protection that helps the cardholder to shop with “confidence knowing that most purchases are protected against theft or accidental damages for 90 days from the date of purchase”.

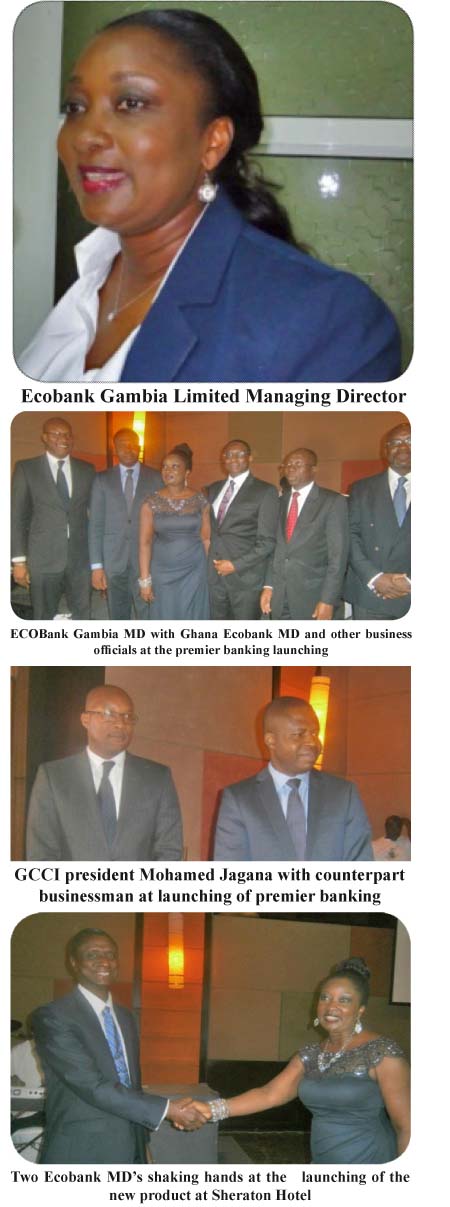

The Premier Banking product is one of Ecobank’s responses to the varied banking demands of especially a fast-growing middle class and elite customer segment, said Ecobank Gambia’s Managing Director Josephine Anan Ankomah, whilst delivering her remarks on the launch of the products.

“This latest addition to our product offering seeks to provide tailored deposit, cash management and credit products and services, customized to individual circumstances, needs and wealth goals,” she said.“We intend to offer these services in a dedicated and comfortablebanking environment.”

Working with a cohesive team of relationship managers, Ecobank is poised to assist customers to meet a broad range of financial needs.

These needs, MD Ankomah said, include investment advisory services tailored to individual wealth plans; credit products, and e-Banking and Electronic card solutions.

“We also have in place attractive customer loyalty programmes with an exclusive range of benefits,” she disclosed. “In launching Premier Banking, we aim to set the ‘Platinum standard’ in terms of customer service in The Gambia.

“Ecobank’s Premier Banking clients will have access to a dedicated private banker, who will work with our team of specialists, not only in Gambia, but also across the 36 countries where we have a presence, to ensure that we meet and strive to exceed all expectations.

“We look forward to all of you becoming part of Ecobank’s elite Premier Banking Family.”

The launching of the Premier Banking product in the Gambia market by Ecobank has marked another significant milestone in the history of banking in the country, Gambia Revenue Authority’s finance and accounting director Alhajie Saihou Denton said in his keynote address on the occasion.

“Premier Banking by Ecobank is about redefining services, redefining products and redefining wealth,” he said, adding: “In launching this unique service, Ecobank essentially is providing an aspirational lifestyle product to which discerning customers will immediately relate.Increasingly today, convenience, personalization and on-demand advice are critical considerations in catering for the needs of affluent banking customers.”

Considering Ecobank as a pan-African bank with Africa at heart, Mr Denton says it is also reassuring that Africa is takenup the lead by capitalizing on the use of technologymaking African people’s dreamscome true by rolling outadditional products that strategically address the needs of its citizens.

“Today Ecobank has gone ahead of its competitors and is able to provide its customers with an instantly Visa Debit card locally,” he noted, saying: “The future is pan-African and Ecobank is the Pan-African Bank.”

Ecobank believes that building intimate relationship with customers is key in enabling the bank manages, builds and protects their wealth, said Ecobank Ghana’s Managing Director Samuel Ashitey Adjei, who represented Ecobank Group CEO at the launching.

“At the heart of this new initiative, which we believe will redefine personal banking in The Gambia, is a team of dedicated Relationship Managers to look after our Premier Banking customers’ very individual needs and provide tailored financial advice,” he said.

The Premier Banking account is one designed specifically for today’s business lifestyle but with the same attention to detail that customers would expect from a Swiss watch, a German vehicle or an Italian suit.

Says Mr Adjei: “Premier Banking customers will be able to access their accounts 24/7 online, through our worldwide network of ATMs and POS terminals or in our exclusive Premier Banking lounges.

“Premier Banking clients will also receive a Platinum Debit card and enjoy a range of privileged benefits, such as discounts from our partners and preferential interest rates with Ecobank.”

Read Other Articles In Article (Archive)