No amount of compensation can really square up for a life lost, or an irreparable damage to a precious property, but receiving one’s insurance claim without much ado is a service that can bring respite to a troubled soul. Standard Insurance Brokers Gambia Limited has heralded a new beginning in providing this service in The Gambia.

Working with insurance companies to find the very best available policies for insurance clients is not the abode of just anyone or institution but of a professional with good standing who can structure policies, settle claims and meet, to a large extent, the expectations of clients.

Standard Insurance Brokers Gambia Limited, a new intermediary between buyers and sellers of insurance policy, has pitched tent in The Gambia to provide insurance solution to the insured and the general public, by serving as a broker in facilitating insurance claims and other services.

The company, which stretches its arm from Nigeria where it has its headquarters, provides services that are relevant to the economic and infrastructure growth needs of various sectors of a country’s economy in which it operates. These include energy, marine, aviation and space, construction and engineering, and financial institutions.

“The Standard Insurance Consultants Limited offers extensive expertise in all the major insurance disciplines,” the company’s President and Chief Executive Officer Mallam Ahmed O. Salawudeen says. “These may be summarised as follows: oil and gas, aviation and space, marine hull and cargo, personal accident insurance, life insurance generally, electronics insurance, automobile insurance, householders, fire/special perils, construction and engineering, political risks, risk management, general third party liability, treaty reinsurance generally, computer all-risk insurance, and general accident insurance.”

Mr Salawudeen says his company’s operations have a strong record of delivery, as demonstrated through the support they provide to companies and individuals, especially in providing claims services.

General claims services

Helping policyholders to ensure their applications for payment of a loss under the terms of their policies go through successfully, is Standard Insurance’s claim to fame.

The acid test of any insurance outfit is “prompt settlement of claims as at when due”. Through its professional brokerage, Standard Insurance has been making sure that its clients generally benefit from prompt settlement of claims.

“That is why at Standard we place claims servicing at the top of our service commitments to our mutual clients,” Mr Salawudeen says. “Our Claims Departments are staffed by highly focused personnel, all of whom respond to any event with the same degree of urgency no matter whether the insured event is small, medium or big.”

The three-decade-old insurance brokers believe placing insurance business in their hands is as safe as houses, since their formula of claims collection is tailor-made to effectively and efficiently meet client’s expectations.

Mr Salawudeen tells of his company’s good standing in this respect: “When placing insurance business with our organisation, our clients are rest assured in the knowledge that their claims collections are in capable hands. All our claims teams work to the same formula in the handling of our clients’ affairs. The formula developed by us over the years is a very simple application and the result is a seamless and efficient claims servicing.”

The company’s approach to claims settlement is captured in mainly its management, negotiation and claims administration skills.

“Upon being appointed as a Client’s Insurance Brokers/Adviser, we put in place the necessary claim procedures to handle our clients’ claims,” CEO Salawudeen said. “These procedures range from basic reporting functions through to the more complex major loss handling report and regular reviews.”

The company has an “excellent team of claims negotiators who have been handling complex claims” over the years. “To this end claims negotiating ability is very strong within our claims team,” Mr Salawudeen assured.

By putting forward a very simple and dynamic procedure, Standard Insurance’s claims personnel administer “all the claims” that occur during the currency of the policy of their clients “very effectively”. “This in effect ensures that our clients’ claims are paid promptly and efficiently as at when due,” Salawudeen reaffirms.

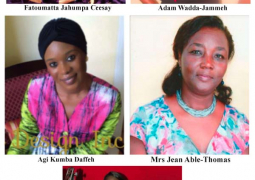

Human resource

Standard Insurance has in place a human resource team that fuels the engine of the service it renders to clients. The professionalism of this team is appraised through training and support to staff, with good conditions of work and appropriate welfare scheme.

“Standard Insurance Consultants Limited places a great premium on the value of staff training,” CEO Salawudeen said. “At Standard, we consider staff training as a foundational cornerstone of our service commitment to our mutual clients and the risk carriers. Having well trained personnel ensures that we provide a truly professional service. Our training programmes are comprehensive both locally and internationally utilizing the advantage of our sister company, ABC Human Development Consultants.

“We also benefit from training organised by our technical partner – Willis Limited in London - in respect of energy, aviation and space, and marine hull and cargo.

“The well trained staff of Standard Insurance Consultants Limited provide comprehensive and elaborate insurance programmes for our clientele. These programmes, including Risk Management, are very cost-effective and meet the insurance requirements of our clients.

“We are one of the well known and reputable insurance brokers in Nigeria and with our strategic owned and associate offices, we are in the best position to provide valuable, local professional insurance service to our clients.”

Mission in The Gambia

Standard Insurance’s expansion into The Gambia is largely driven by the wish to provide excellent insurance services to the Gambian community, both in the private and public sector of the country’s economy, such as it has done in other countries as Nigeria and the UK.

Standard Insurance Consultants Limited has been registered and licensed by the regulatory authority in The Gambia (the Insurance Department of the Central Bank of The Gambia) as a professional insurance broker “to transact all classes of insurance business including Special Risks with all the major carriers in The Gambia”.

“As we have been successful in our business operations in Nigeria and the United Kingdom, it is our wish to replicate this professional practice by providing excellent insurance services to the Gambian community, both in the private and public sector of the Gambia economy,” said MD Salawudeen, whose new insurance entity in The Gambia has its head office at the 4th floor of the Sankung Sillah Building on 52 Kairaba Avenue.

Profile and experience

Standard Insurance Consultants Limited and its Sister Company Standard Life & Pensions Consultants Limited is an independent Insurance/Reinsurance Brokers that has its Headquarters in Lagos, Nigeria, with branch offices at Ibadan, Abuja, Port Harcourt and Associate offices throughout Nigeria.

Standard Insurance Consultants Limited is a functional member of the National Council of Registered Insurance Brokers (NCRIB) and fully licensed by the National Insurance Commission (NAICOM) to transact all classes of insurance business including Special Risks such as oil and gas, aviation and space, marine, general insurance and life insurance business.

CEO Saluwadeen explains: “We are duly licensed by the Department of Petroleum Resources (DPR) to operate as an oil industry service company (Special Category) as well as the Nigerian Petroleum Exchange (NIPEX) including NAPIMS.”

Employing over 52 insurance professionals across Nigeria and with its international backing by its technical partners at Lloyds in London, Standard Insurance Consultants Limited offers extensive expertise in all the major insurance disciplines, Mr Salawudeen says.