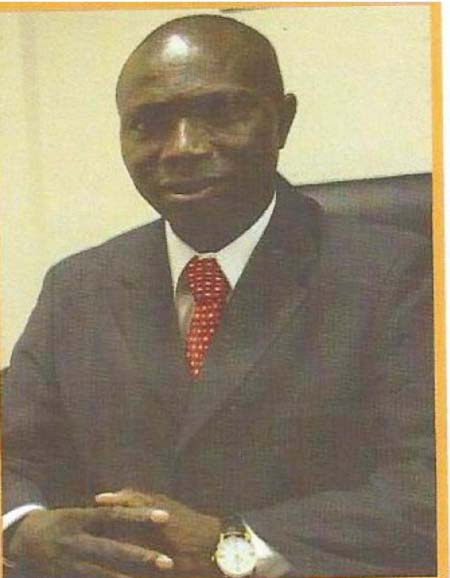

The managing director of AGIB, Nuha Marenah, recently told The Point newspaper that the bank’s transformation is three-pronged.

It will be done through the deployment of the right technology, the requisite expertise in terms of human resources, and the restoration of public confidence in the bank.

“Already, we have got the best technology available in the market; we have an experienced all-Gambian team of management, and there is renewed public confidence in the bank,” Mr Marenah said in an exclusive interview at his office in Banjul.

The improvement of the bank in terms of technology and human resources will be a continuous thing, he said.

“This is cognizance of the fact that without your people – the right expertise – you cannot do anything; without your technology, you cannot do anything.Also, without public confidence, you cannot do anything as a bank,” he said.

“We have got all of these three things together, so we can only go up.”

AGIB has a new board and management after Muhammed Jah, one of the wealthiest Gambian businessmen, bought 76.45 shares of the bank in May 2014 from the former Nigerian owners, hence giving it a Gambian face.

Subsequently, the entire board and management of the bank have been changed to reflect the current realities.

On 6 November 2015, AGIB, under the chairmanship of Muhammed Jah, held its first annual general meeting.During the event, the management reported a profit of D12.7 million in 2014, from just D1.4 million in 2013.

“I want to assure everybody that this is a different bank now,” said MD Marenah, who has more than 30 years of banking experience having worked in Afghanistan, Angola, Jordan, Ghana and The Gambia.

He said they have bought state-of-the-art software called iMAL, a pure Islamic bank core software used in more than 100 Islamic banks.

Also, as part of efforts aimed at putting the right structure in place, nine young Gambians with the requite expertise in different areas of finance were hired.They were sent for hands-on training in Khatoum, which has one of the best Islamic banks in Africa.

“We have now become a full Islamic bank as we got the right technology and the relevant expertise,” Mr Marenah said.

He said the bank has bought six new ATMs that are ready to be installed for the convenience of the customers.

AGIB is ready to dole out a lot of new and convenient products and services, including internet banking all geared towards propelling it to the top spot in the competitive banking industry.

AGIB in yesteryear

Before the management changes, AGIB had been operating on the brink for several years with little or no profit for the shareholders and most of, if not all, the senior managers were non-Gambians.

There was no annual general meeting since 2011 when the last one was held, and the board meetings were sporadic, before the change of hand, for 18 months.

“It cannot be worse than that because these meetings really help management.They tell you where you are doing wrong and where you need to consolidate, and whether you are complying with certain rules and regulations,” Mr Marenah said.

“So these are very important bodies, but they were non-functional in the previous regime, under which the bank was not making any profit.”

Also, the bank could not increase its capital requirement as the Central Bank of The Gambia, the regulatory bank, ordered.

As a result, the bank was under prescription whereby officials of Central Bank were directly involved in overseeing some operations of the bank.

The central bank had initiated a recapitalisation programme, for all the banks operating in the country to increase shareholder fund to D150 million by 31 December 2010 and D200 million by 31 December 2015.

“So when we came in, one of our first objectives was to see to it that the bank meets the Central Bank requirement,” Mr Marenah said.

“We were able to make it.As of 31 December 2014, AGIB has capital of D243 million thereby exceeding the capital requirement by D43 million, one year ahead of the deadline, because the chairman injected some capital into the bank.”

The new board of directors and management of AGIB are doing all it takes in terms of capital, technology and expertise to put the bank on a sound footing, according to observers.