Ndow made the claim during an earlier testimony on 17th March, promising to return with documentation proving the funds came via Mbacke Financial Service.

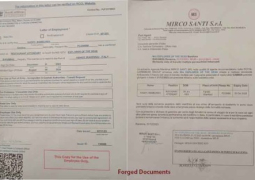

However, at his latest appearance before the Local Government Commission of Inquiry (LGCI), Ndow provided documents of money transfers allegedly sent to him by his sister through Mbacke Financial Service . However, the documents lacked critical verification elements such as signatures, stamps, or official letterheads.

While Lead Counsel acknowledged the documents’ existence, he emphasized they were insufficient to prove origin or legitimacy. “We will admit the documents just to show something exists, but this does not prove they are from Mbacke Finance,” he said.

Ndow also claim that some funds were not through transfer at Mbacke Financial service but from individual, when asked about the individual

He said he forgot the names, but he would have to consult his sister to clarify them.

However, Lead Counsel reminded him that several months had passed since his first appearance, and he had ample time to produce proper evidence.

The Commission reviewed bank statements showing substantial deposits in Ndow’s account during the licensing pitch period (January to July)

January 2021 alone, he deposited D100,000 on January 5th; D174,600 on February 8th; and D663,769.21 on February 15th

Equally in February 2021, he deposited D20,000 on February 10th; D100,000 on February 17th; D178,500 on February 28th; D125,000 on March 9th, D140,000 on March 16th.

In the same pattern observed in 2022 coinciding with peak revenue collection periods he deposited D304,500 on January 17th, a sum of D170,000 on January 28th and D330,000 on February 24th.

Ndow’s monthly salary was D13,000, later increased to D20,000 far below the sums deposited into his account. Lead Counsel noted that even a D50,000 salary could not explain the frequency or volume of the deposits. Ndow claimed the money was sent to him by his sister and others for safekeeping but provided no supporting evidence.

“This is highly suspicious,” the Lead Counsel said. “In the absence of credible proof, we suspect these funds may be proceeds from public revenue collected under your watch.”

Ndow also faced tough questions about the invoicing process under his leadership. He admitted that he and Macumba Sanneh issued invoices to tailoring businesses during inspections. Lead Counsel raised concerns over the lack of verification mechanisms, such as confirming the number of sewing machines or conducting proper assessments.

Ndow claimed that “the whole team” participated in inspections but conceded that only he and Sanneh issued the invoices. He also confirmed that businesses self-assessed their value, and there was no requirement to submit financial statements or other proof.

He added that he had verbally suggested reforms to the former Finance Director but did not formally raise them at the council level. The Commission questioned why he continued to operate under a questionable system if he recognized its weaknesses.

Internal audit reports presented to the Commission confirmed that many businesses were either overcharged or undercharged.

Ndow also admitted there were inconsistencies between data recorded in the licensing system and the actual invoices issued. Asked why this happened, he could not provide a clear explanation but agreed there were “serious discrepancies.”