The

Insurance Association of The Gambia (IAG) yesterday held a daylong forum on

taxation, for finance officers and other senior members of insurance companies,

brokers and reinsurance agents in the country.

It

was the first training course organised by the IAG that is non-insurance

related, since the establishment of the association in 1987.

The

taxation training course, held at a hotel in Kololi, was delivered by Accord

Associates, a specialised taxation firm and it was geared towards further

enhancing the tax compliance of the insurance industry.

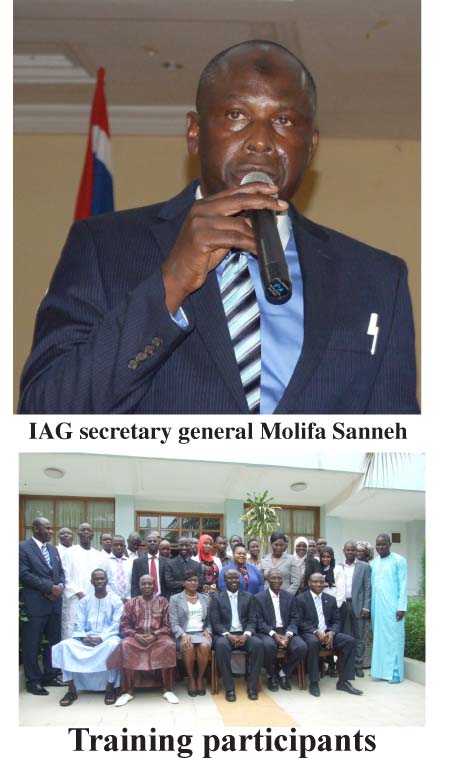

Molifa

Sanneh, executive secretary of the IAG, said the forum was organised to

complement the Gambia government’s efforts in enhancing tax compliance through

tax education.

“The

government, through the Gambia Revenue Authority, has been sensitising the

general public for the past years about taxation, in order to enhance tax

compliance.

“So

we also felt it prudent to join the government to complement their efforts in

this regard, because no country can function properly without taxation and, as

a company, not knowing your tax obligations is not an excuse.”

He

explained that the IAG’s way of complementing the government to enhance tax

mobilisation is to help insurance companies know their tax obligations, by

organising a forum on taxation.

The

IAG secretary general said the forum was expected to help the insurance

industry players understand their tax obligations to their fingertips, so they

can further improve on their compliance.

Already,

the insurance industry is among the most tax-compliant sectors of The Gambia,

if the GRA tax award is anything to go by.

During a forum organised by the GRA to award tax-compliant companies and

organisations, several insurance companies were awarded.

Mr

Sanneh said the insurance companies, courtesy of the IAG, recently had a

meeting with the GRA at which the insurance industry was hailed for being tax

compliant.

“So

the daylong training on taxation was to further enhance the compliance of the

industry, as there is always room for improvement,” he said.

Makaira

Badjan, vice president of the IAG, said The Gambia’s insurance industry

currently underwrites about D200 million and a good chunk of that is paid to

the GRA as tax, be it value-added tax, corporate tax, or income tax.

“We

contribute immensely towards taxation because we see it as a national

development issue, and it is our obligation to contribute to the development of

the country,” he said.

Mr

Badjan, also the managing director of Royal Insurance Company, said the

insurance industry sees the GRA as a partner; not just a tax regulator, but

partners in the development of the country.

He

said the IAG’s training course on taxation is a manifestation that “the

insurance industry takes its tax obligations very seriously”.

He

affirmed that the insurance industry is “a lot compliant” not just with its tax

obligations, but also with the Central Bank of The Gambia, as the regulator of

the industry.

“This

is all because governance is very key to the industry, and we strive as much as

possible to do what is really right, to protect the policyholders and to ensure

the viability of the industry.”

However,

there is always room for improvement; hence the training course on taxation for

insurance officials, he added.