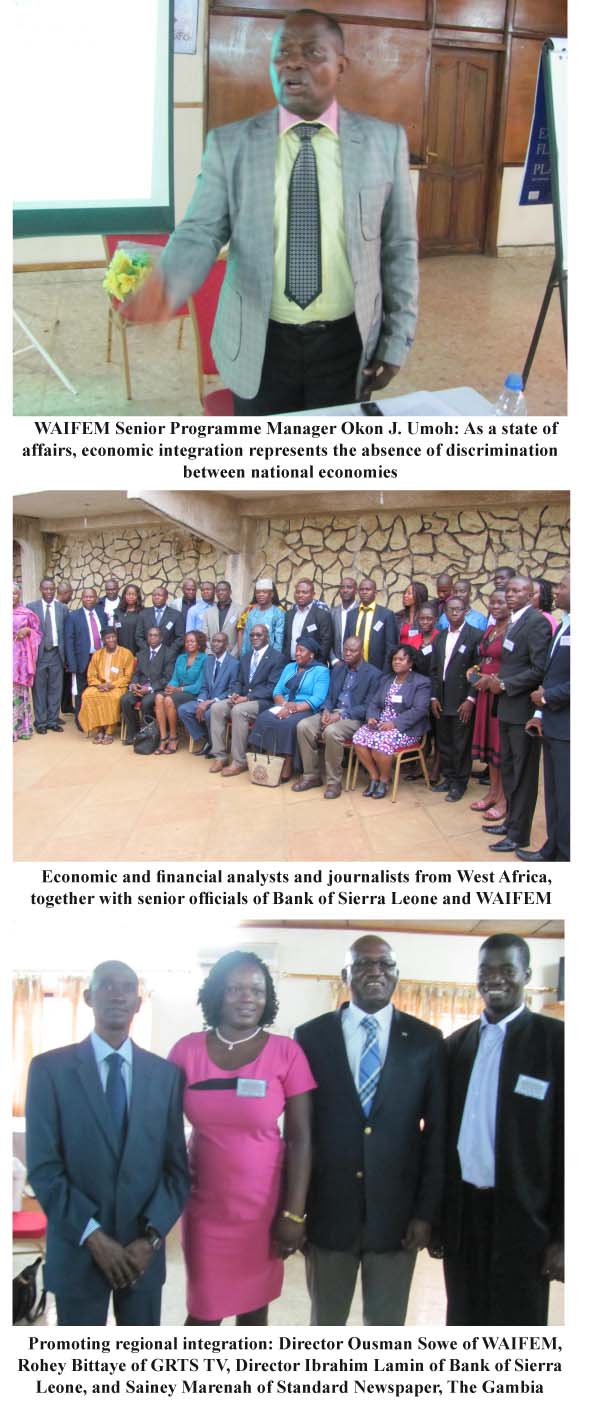

“Regional integration is appropriate for Africa, a continent characterised by small countries, small economies and small markets,” says WAIFEM senior programme manager Okon J. Umoh, while presenting a paper on Regional Economic Integration: Rationale, Challenges and Prospects, at a weeklong course in economic and financial analysis held in Freetown, Sierra Leone, from 22 June to 1 July 2014.

“What is at issue, however, is whether the linear model of regional integration currently, defining the African integration paradigm, makes sense for the continent,” he notes.

Africa, a marginalised and fragmented continent, has continued to engage at the periphery of the global economy, as is evident from the continent’s declining share in global production and trade.

The majority of sub-Saharan Africa’s 47 countries are small and least developed, according to UNCTAD, which makes integration very essential for the region.

According to Dr Umoh, the rationale behind regional economic integration covers various socio-economic, developmental and political considerations, including the promotion of intra-regional trade, socio-economic policy coordination, and management or development of shared physical infrastructure and the environment.

“Some of the African regional arrangements also cover issues of common interest in the areas of public governance, defence and security, among other socio-economic and political dimensions,” he says.

The WAIFEM senior programme manager maintains that regional economic integration is also borne out of decolonization agenda and the desire to overcome the colonially imposed “artificial” boundaries.

“Regions also need post-independence economic integration to gain bargaining power and survive economically against the threat of marginalization in the globalization process,” Dr Umoh says.

Integration, he as well notes, is also aimed at “achieving efficiency gains” through the enhancement of the commitment to harmonization and integration, protection of the integrity of the region; reduction in transaction costs through the provision of common services, and effective use of scarce human resources.

According to Dr Umoh, most of Africa’s countries have low per capita income levels and small populations, which result in small markets.

“In 2008, 19 SSA [sub-Saharan African] countries had a gross domestic product (GDP) of less than US$5 billion, six of which had a GDP of less than US$1 billion,” he said, adding: “Not only are most SSA economies small and poor, but 15 are also landlocked, an important contributory factor to high trade transaction costs, and more generally to the high costs of doing business in Africa. In addition to border barriers, many other constraints exist, increasing the transaction costs of trade.”

Geography is an important consideration, he also notes, saying that per capita densities of rail and road transport infrastructure are low because in colonial times they were designed to transport primary products to the ports.

Throughout the continent, many road, air, and rail networks remain unconnected, as there are poorly developed cross-country connections, he added.

The rationale for regional economic integration and how the positive effects of integration can be manifested are through economies of scale, complementary economies, efficient use of resources, export-oriented industries; and peace and security, Dr Umoh states.

Advantages and disadvantages of regional economic integration

The WAIFEM senior programme manager also expatiates on the realities of the regional economic integration drive, saying the initiative has a great deal of advantages and some challenges.

The advantages, Dr Umoh says, include trade creation, greater consensus among member countries on trade and other issues; political cooperation; employment opportunities; and wider markets and competition for growth and development.

And the disadvantages or challenges, he notes, are creation of trading economic blocs, which increases trade barriers against non-member countries; trade diversion because of trade barriers despite the inefficiency in cost, and compromise of national sovereignty as integration requires member countries to give up some degree of control over key policies like trade, monetary and fiscal policies.