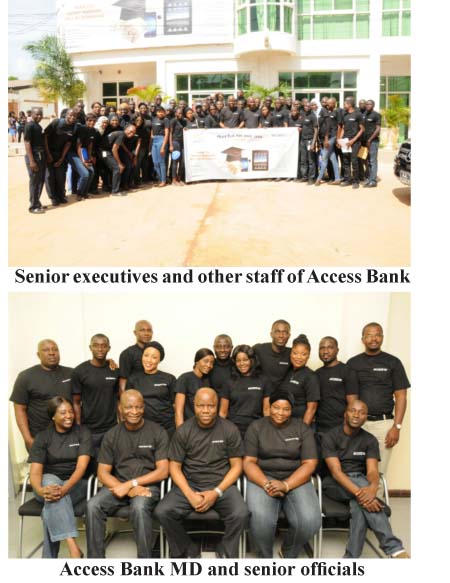

Access

Bank Gambia Ltd has officially launched a new product called Yorkka sa am am

promo (meaning SAVE TODAY TAKE TOMORROW).

The

launching of the product provides opportunity for customers of the bank to reap

more dividends for their savings culture through a raffle draw, which can also

be of benefit to people who become new customers of the bank.

“In

furtherance of our business goals and objectives, we have designed a business

promotion plan titled YORKA SA AM AM (SAVE TODAY TAKE TOMORROW) scheduled to

run from August 1st to December 2017,” the bank said in a statement sent

yesterday to The Point.

“It

is a comprehensive project aimed at increasing our Savings and Current

Accounts,” it added.

The project implementation plan includes mass

marketing (market storm) by our staff to public and private institutions like

Government ministries, agencies and parastatals, markets, educational

institutions, etc.

The

campaign focuses on promoting a bouquet of products and services, including

Mobile Banking, VISA/Verve cards and Reactivation of Dormant Accounts.

There

are prizes to be won during the End of Year Mega Raffle draw to be held in

early 2018.

Qualified

customers will be able to access loan financing from the bank, cash rewards,

IPAD, scholarship, mobile phones, flash drives, framing tools, branded canopy

market stalls, fertilizers bags, farming tools, airtime coupon, NAWEC tools,

fuel coupons and many more.

Speaking

in an interview with The Point on Monday at the launching ground at Access Bank

head office, Abisatou Manneh, the Lead Corporate Communication officer, said the promotion will be running for six

months and by the end of it all, there will be a raffle draw, whose prizes

include scholarships, farming tools, mobile phones and other valuable items.

She

said the project is out to increase mass awareness of the bank’s products and

services; promote banking and savings culture among the people of The Gambia;

promote the Central Bank of The Gambia’s (CBG) laudable objective of financial

literacy and inclusion; improve standard of living of winners of the prizes on

offer; provide easy and convenient access to banking products and services for

The Gambia public; promote general prosperity by providing financial support to

enable eligible customers take advantage of business opportunities through

credit finance.

She

said although it was launched internally a couple of days ago, they will be

going externally to reach out to the public.

She

added that the promotion will continue to different sectors and areas such as

marketplaces to get as much customers as possible to open their accounts with

Access Bank to save money for themselves and for their kids.

“Really

what we are trying to do is to get Gambians aware about the banking system as

well as to know how value the banking system is; basically that is what the

promotion is all about,” she said.

Ms

Manneh called on the general public to join or open accounts with the bank as

there are many things they can benefit from by doing so.

“Saving

is quite good for the Gambian people,” she said, adding that people can go to

all Access Bank’s branches in Banjul, Brusubi, Latrikunda, and Serrekunda to

open accounts and benefit from the promo.

“We

will also be going to marketplaces to meet women so that they can also benefit

from this raffle draw,” she said, adding: “So far we have a branch in Barra

with a total of six branches right now and we have one here - the head office

at Kairaba Avenue.”

She

said: “The promotion has already started in Barra so if you open an account in

Barra you will be part of the promotion because we have the verve card and the

visa card and when you open an account with us, you will be automatically added

to our prizes.

“We

have just reduced the cost of the verve cards and visa cards - which is very

good. The visa cards now will be D750 and the verve card will be D350.00.”

She

continued: “We are reducing quite a bit to help our customers because our

customers tell us what they want. We are here for our customers.”

Ms

Manneh recalled the accolades and awards of Access Bank over the recent years

for its excellent products and service to the banking world.

Access

Bank is winner of the 2013 African Banker of the Year Awards; winner of the

2011 Business in Community (BITC) Big Tick Awards; winner of the 2011 FT/IFC

Sustainable Bank of the Year Awards, and winner of the 2010 Most Active GTFP

Issuing Bank in Africa.

Read Other Articles In Article (Archive)

Tribute to Late Alh M.B Njie a Senegambian "Prince"

Apr 2, 2009, 8:31 AM