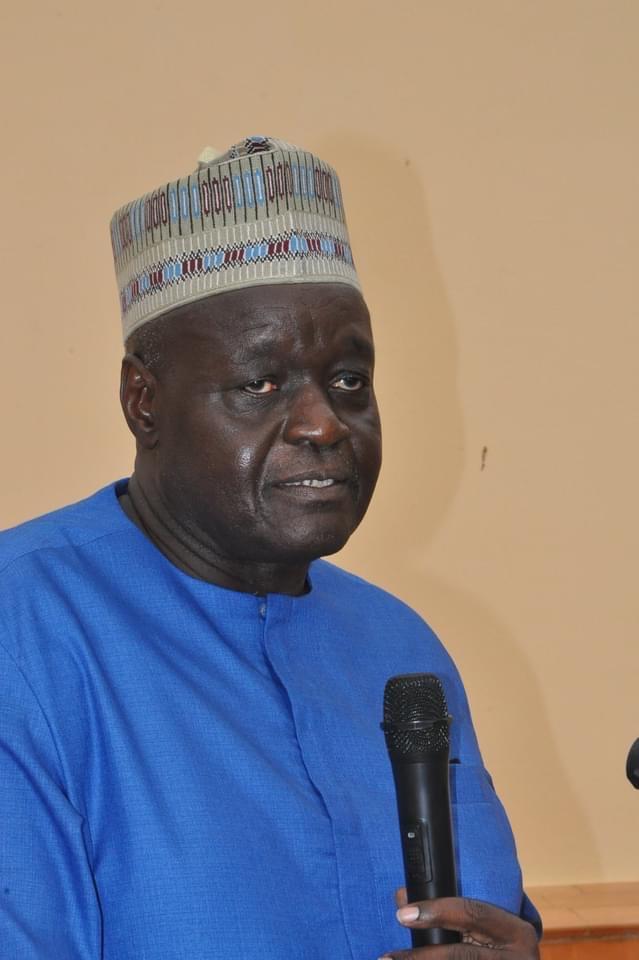

Addendum to my eulogy of the passing of an Icon and Legend- Alhaji Abdou Sara Janha.

His Legacy will be etched forever in the annals of The Gambia. Alhamdulilah.

Retrospection of my speech delivered on 16 February, 1993: Abdoulie M. Touray at the opening of the National Investment Board (NIB) headquarters was incredibly forward-thinking for its time. It provided a strong roadmap for public enterprise reform, privatization, private sector development, investment promotion, capital market development, and human resource development.

Summary of 1993 Recommendations

Public Enterprise Reform via Performance Contracts

Status: Partially Implemented.

Many public enterprises (PEs) were restructured in the 1990s and early 2000s (e.g., GPTC was dissolved, GAMTEL was partially liberalized).

However, lack of continuity and political instability reversed or stalled gains. Performance contracting never fully institutionalized post-2000s.

Privatization and Divestiture

Status: Partially Implemented.

Several public enterprises were restructured (e.g., Gambian Commercial and Development Bank - GCDB now Trust Bank Gambia Limited now a leading bank.

But many strategic enterprises like NAWEC, GPA, and GAMTEL remained state-controlled.

Recent efforts to privatize or restructure key PEs have been slow or politically sensitive.

Capital Market Development (Stock Exchange)

Status: Delayed, Now Implemented.

The Gambia Stock Exchange (GSE) was launched in 2023 — 30 years later than recommended.

It is still in its infancy, with very few listings and limited market depth.

Investment Promotion and Export Diversification

Status: Partially Implemented.

GIEPA (Gambia Investment and Export Promotion Agency) was established in 2010 to replace NIB.

However, The Gambia’s exports remain highly undiversified (primarily groundnuts, cashew, fish).

Agro-processing, fisheries, horticulture still have untapped potential.

Human Resource Development

Status: Still a Major Gap.

Significant progress in education (University of The Gambia, University of the Civil Service, University of Science and Technology, etc tertiary institutions).

Skills mismatch remains high — youth unemployment, underemployment, and gaps in technical, entrepreneurial, and agricultural skills persist.

Financial Sector Deepening

Status: Partially Implemented.

More commercial banks now exist (Access Bank, Ecobank, Zenith Bank, GT Bank, Vista Bank , BSIC etc.).

No strong venture capital fund, leasing company, or fully fledged investment bank emerged.

Microfinance grew, but SME financing and capital market access are still weak.

Export Development Focus

Status: Underdeveloped.

Minimal export diversification and value addition.

Weak backward/forward linkages in fisheries, agriculture, and horticulture.

Islamic Banking, Leasing, and Venture Capital

Status: Not Fully Implemented.

There are now a few Islamic microfinance institutions.

No major Islamic Bank.

No Venture Capital Fund.

No Leasing company.

No Housing Bank

No Agricultural Bank

No Development Bank

32 Years Later: Way Forward for Investment and Economic Development

- Public Enterprise Reforms 2.0

Institutionalise Performance Contracts — reintroduce them under a modern Public Enterprise Reform Framework with real accountability and a dedicated regulatory agency (similar to Kenya’s Government Investment Corporation model).

Gradually corporatize, reform, or privatize non-strategic SOEs like GPTC was done, while preserving strategic ones with professional management.

- Accelerate Capital Market Development

Support listing of state-owned enterprises (SOEs) on the GSE to deepen liquidity and improve transparency (e.g., Gamtel, Gamwater, GamPetroleum).

Encourage diaspora bonds and green bonds issuance.

Create tax incentives for companies that list on the stock exchange.

- Special Economic Zones (SEZs) Fast-track development of Industrial Parks and SEZs focused on agro-processing, fisheries, and logistics.

Build linkages with regional markets (ECOWAS) for exports.

- Investment Bank and Development Finance

Establish a Development and Investment Bank — revisit the earlier concept.

Focus on long-term infrastructure, housing, and SME financing.

Engage IFC, AfDB, and Islamic Development Bank for co-financing.

- Islamic Finance and Venture Capital

Promote establishment of a full-fledged Islamic Bank (like Jaiz Bank in Nigeria).

Set up a Gambia Venture Fund with diaspora and institutional investors — targeting agribusiness, renewable energy, and technology.

- National Human Capital Strategy

Align education with market needs — Technical and Vocational Education and Training (TVET) expansion.

Incentivise private sector training academies in agriculture, tech, and finance.

- Export Diversification and Agro-Industrialization

Focus aggressively on agro-processing zones for groundnuts, cashew, sesame, fisheries.

Provide export credit guarantees and insurance.

Modernize fisheries ports and cold chain facilities.

- Digital Economy

Develop a Digital Transformation Strategy — digitalize government services (e-governance), promote tech startups, and ICT infrastructure.

Use the Gambia Innovation, Technology, and Entrepreneurship Center (GiTEC) as a launchpad.

- Diaspora Engagement Strategy

Launch “Invest Gambia Diaspora” platform — tapping into remittances for investments.

Provide incentives like diaspora bonds, preferential tax rates for diaspora-owned enterprises.

- Strengthen Investment Promotion and Facilitation

Rebrand and strengthen GIEPA into a One-Stop Investment Center.

Digitize all registration and licensing processes.

Target niche sectors like medical tourism, education, renewable energy.

Respectfully Submitted

Ambassador Abdoulie M Touray

Founder/ President

SaHel Knowledge Campus Think Tank ( SKCTT).