Speaking at a two-day meeting and training organised by GRA and held at the Senegambia Beach Hotel, CG Yankuba Darboe said Gambians need to understand that The Gambia is a tax-based economy.

As far as GRA is concerned, once engaged in profit-making or income-generating business, “you must pay your taxes” as hiding or dodging paying tax is deterring national development, he said at the commencement of the training on Wednesday 8 February 2023.

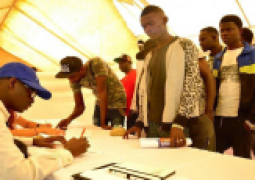

The training, on the topic: Post Clearance Audit (PCA), targeted importers and their agents in the country.

It should be known that for 2023 GRA has been tasked to collect D15.2 billion as annual revenue for government, CG Darboe said, adding that GRA will therefore not relent in its efforts to be collecting the much needed revenue for national development.

He reiterated that The Gambia relies on taxation hence the reason for voluntary tax compliance to avoid interruption in the collection of government revenue.

He also issued a stern warning to those that are engaged in businesses and are not obeying their tax obligations.

GRA will not compromise with non-tax compliant businesses or individuals, he said, adding that the Authority would execute its mandate to the letter to ensure that non-tax compliant businesses and individuals are brought to book.

“One day GRA will get into your business and penalty will be instituted against you for non-tax compliance,” he forewarned.

Mr Darboe emphasised the relevance of the training, saying it would go a long way in helping the importers and clearing agents to effectively do their job with less hindrance.

According to CG Darboe, a couple of years ago, GRA got the advice from their development partners to introduce POST Clearance Audit PCA) instead of the training being done in yesteryear by the ‘jacking section’ under the audit department of customs. Under the PCA, quality and appropriate training is offered to trainees over the years.

CG Darboe also revealed that GRA is now on the verge of fully digitalizing all their processes. Hence he called on the cooperation and understanding of importers and clearing agents in the country.