Several prominent lawyers and an accountant have appeared before the Commission of Inquiry into tax evasion and other corrupt practices, which commenced sitting Monday at the premises of the high court in

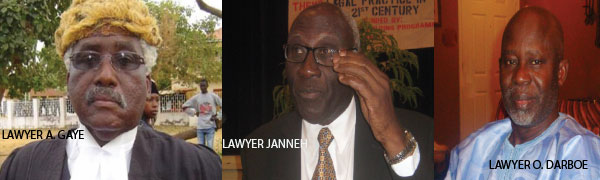

The lawyers were the doyen of the Gambian Bar Association, Lawyer Surakarta Babucarr Samega Janneh, and three other prominent Gambian lawyers, namely,Ousainou Numukumda Darboe, Antouman Gaye and Cheyassin Ousman Secka.

Amadou Sanneh, a chartered accountant and proprietor of AA & Co Consulting also reported to the commission.

The commission of inquiry looks into tax evasion and other corrupt practices of accountants, legal practitioners; companies; and private persons, medical practitioners and institutions required to pay tax to the Gambia Revenue Authority.

It was set up by the President in October 2011 to, among other things, ascertain the extent of loss of public revenue resulting from non-payment of capital gains tax, personal income tax and sales tax; and to determine the role of individuals, groups and professional bodies in the evasion and avoidance of tax.

The lawyers and accountant all appeared to shed light on issues related to tax payment, employees, among others.

The new tax commission is chaired by Justice Fatima Singhateh, and she is assisted by two other commission members.

Its mandate includes enquiring into professional malpractice by members of the public as it relates to obtaining goods through widespread issuance of false and dud cheques and other malpractices by members of professional bodies as these have affected foreign direct investment in The Gambia.

Speaking at its first sitting, Justice Singhateh said the commission was established for the public good and in the interest of the general public and, as a result, the commission hereby solicits the support and cooperation of each witness summoned, and each and every member of the public.

“If any member of public has any concern or information relevant to the mandate of the commission they are most welcome to bring such information or raise such concerns in writing to the commission through the secretary of the commission,” commission chairperson Singhateh said in her brief introductory remarks.

First to appear was Lawyer Cheyassin Ousman Secka, who gave the commission information pertaining to his qualifications, payment of income tax, sales tax, and private legal practitioner’s tax.

He told the commission that he is a private legal practitioner called to the Bar in October 1973.

Lawyer Secka added that he is fully aware, not only as lawyer, that all citizens owe an obligation to the state in paying tax.

The senior lawyer further told the commission that, “from January 2001 to 2007, I did not practice as a legal practitioner. I resumed practice in 2008 and I have written to the commissioner of domestic tax informing him about my payment of tax and ‘pay as you earn tax’ for my employees from June 2008 to 2011”.

Counsel told the three-member commission that he was assessed up to end June and was aware of “pay as you earn tax”, which he said is to pay monthly while income tax is payable every six months.

He showed the commission some of the receipts of his domestic tax payments, adding that his personal income tax is yet to be settled, but has the receipts from 2008 to 2011.

The receipts were admitted and marked as evidence.

Next to appear was senior counsel Antouman Gaye, who also provided information, among others, on his qualification and tax payments.

Gaye told the commission that he is a private legal practitioner, and was called to the bar of England in 1974, appointed a magistrate in 1976, and was at one time a Master of the High Court in

He recalled going into private practice in 1980.

Asked by the state representative at the commission, Morris Aiagh, the number of people employed at his chambers, Gaye replied: “I have three of my children working with me at the chambers, who joined me at different intervals; the first joined in 2005 and others in 2009 and 2010 respectively.” He also employs two clerks and one secretary.

Lawyer Gaye said from 1980 to date he has been paying tax. With regard to his income and sales taxes, he said before the setting up of the tax commission he did check to find out whether he has any outstanding arrears to settle.

Gaye showed the commission his sales and income tax receipts from 1999 to 2011 which were marked and admitted as evidence by the chairperson of the commission.

Surakarta Babucarr Semega Janneh also informed the commission that he was called to the Bar of England in 1970 and to the Gambian Bar in 1971.

He said he has been practising since 1973, and has been paying his taxes up to 2011, and has been paying on a quarterly basis.

“I have receipts for income tax and sales tax,” he said before showing to the commission the receipts, which were admitted and marked.

Lawyer Janneh also told the commission that he has a tax clearance certificate for all his taxes, from 1999 to date.

Lawyer Ousainou Darboe said he was called to the Nigerian Bar in 1973 and Gambian Bar in the same year.

He said he worked at the Attorney General’s Chambers in 1973, and rose to the rank of registrar general, but in 1980 went into private practice.

He said he is a private legal practitioner, and become a politician in 1996.

Lawyer Darboe told the commission that he has been paying his taxes.

“I have paid all my personal and sales taxes, because it is required by the law for citizens to pay. I have paid all my taxes before I even contested elections in this country from 1996 to 2001 and 2002 to 2006 and have receipts of sales and income tax,” he added.

Darboe’s domestic tax receipts from 2006 to 2011 was admitted and marked as evidence.

Amadou Sanneh an accountant also appeared and provided information to the commission.

Read Other Articles In Article (Archive)

Lawyer Moses Richards begs for mercy

Oct 11, 2011, 3:15 PM

GFF to take ‘necessary action’ against Scorpions appalling performance

Oct 15, 2015, 10:56 AM