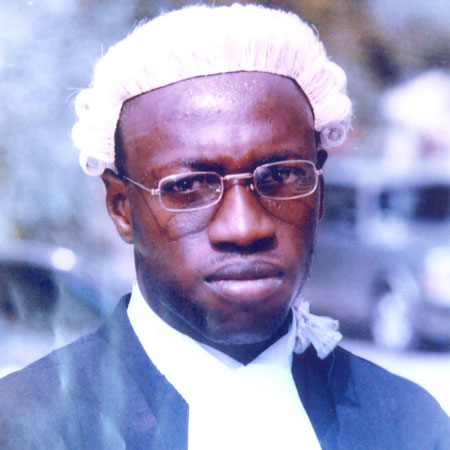

Lawyer Badou Conteh on 8 June, 2009, challenged one Ousman Njie, a banker by cross-examining him in defence of his client, Gerald Sheely, a British national, who was charged with "selling forged bank notes and uttering false documents".

The witness, Ousman Njie, was asked whether the cheques were sent for clearing when the accused presented them, but he answered in the positive.

He was again asked where the cheques were sent. In response, he told the court that they were sent to the Standard Chartered Bank's clearing bank. When he was asked whether he knew the name of the clearing bank, he said, he believes it was the Royal Bank of

Still under cross-examination, the accused was further asked whether he was guessing where the cheques were sent, he replied that they were sent for clearing but did not know the name of the bank.

When asked who authorised the payment, he responded that it was the American Express. Asked why the payment was authorised, he stated that it was because the serial numbers of the traveler's cheques were given to American Express, and that they were given on online authorisation.

When asked whether cheques were prepared, checked and authorised for payment by the bank, he answered in the positive.

When put to him that the receipts were prepared, checked and authorised for payment by the bank, he said, it was correct.

Asked whether after the incident with the accused, the bank had a new operation for verifying traveler's cheques, he responded in the positive.

Questioned whether before the introduction by American Express of the "Physical checking" was it easy to distinguish between a false cheque, he said, it was easy depending on the quality of the forgery.

"You are not telling the truth. It was difficult to know whether a cheque was false or genuine before the 'physical checking' was introduced," Badou Conteh challenged the witness.

"It depends on the quality of the forgery," the witness repeated.

It was put to the witness that the bank was partly negligent by paying the cheques. The witness has pointed out that he would not admit that.

"A bank like yours should have known the physical checking. You were negligent," Badou Conteh put it to the witness.

In response, the witness told the court that this was the first incident when they had genuine notes with false serial numbers.

Read Other Articles In Article (Archive)