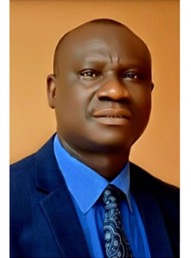

Speaking in a news conference aimed to give an update on the country’s current economic outlook, CBG Governor Buah Saidy, said: “The stock of domestic debt stood at D38.4 billion as of July 2022, from 37.2 billion in 2021.

However, he added the domestic debt-to-Gross Domestic Product ratio declined from 35.4 percent in 2021 to 33.3 percent at end of July 2022.

“Short-term debt still accounts for more than half of the domestic debt and refinancing and interests’ rate risks remain elevated,” he said.

Speaking further, Mr. Saidy said yields on government securities have started rising, noting “weighted average interest rate on treasury bills increased from 3.2 percent in July 2021 to 7.2 percent in July 2022.”

However, the financial expert said the country’s banking system continues to be stable with robust financial soundness indicators.

Buah justified that the risk-weighted capital adequacy ratio stood at 27.8 percent at end of June 2022 and added all banks were well above the regulatory requirement of 10 percent.

“The liquidity ratio of 73.2 percent was also above the prudential requirement of 30 percent. Asset quality has improved with decline in the industry’s total non-performing loans to 4.2 percent of gross loans as end of June 2022 and banks have continued to maintain adequate level of provisioning,” he said.

The CBG top official informed that a stress exercise conducted by CBG has revealed that the banking industry remained solvent even with a 400 percent shock on asset quality.

“Annual broad money growth declined by 14.0 percent in June 2022 from 27.5 percent in the correspondent period last year, reflecting a slowdown in the growth of the net foreign assets of both the Central Bank of The Gambia and commercial banks,” he divulged.

Moving forward on annual growth in reserve money, he said the bank’s operating target decelerated to 8.2 percent from 31.0 percent over the same period.

“Reserve money was above the target for June quarter by D2.1 billion, reflecting the rise in the net domestic assets (NDA) of Central Bank.