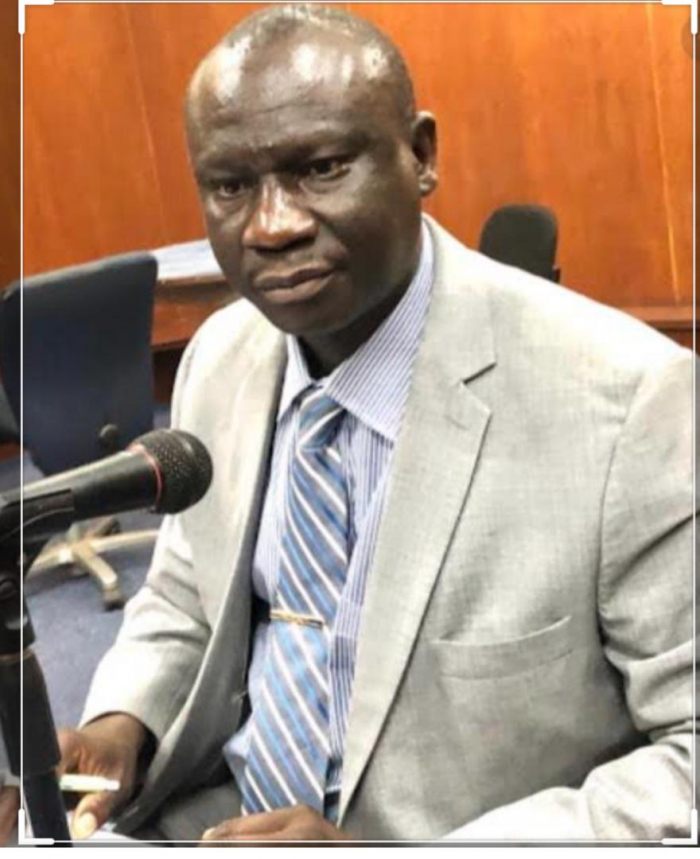

Governor Saidy revealed this after the Monetary Policy Committee (MPC) of the Central Bank convened its quarterly review of economic and financial development.

He continued to state that headline inflation peaked at 8.2% in July 2021 from 4.8% in the corresponding period a year ago, attributing this to increase in food prices.

“Consumer price inflation on food and non-alcoholic beverages accelerated to 11.5% during the review period compared to 5.2% a year ago. The main drivers of food inflation were rice, vegetables, oils and fats, sugar, jam, honey and sweets, and other food products,” Governor Saidy added.

Continuing to brief journalists on the country’s price development, the governor further stated that non-food inflation also rose to 4.5% in July 2021, up by 0.3% point the same period last year. He added that except for miscellaneous goods and services, hotels, cafes, and restaurants, the remaining sub-components of non-food items contributed to the increase in non-food inflation.

Dwelling on foreign exchange market developments on fiscal operations, he said the total revenue and grants mobilised in the first half of 2021 totalled D8.2 billion (8.7% of GDP), lower than the D8.7 billion (9.2% of GDP) registered in the corresponding period a year ago.

“The fall in revenue and grants was largely explained by the 23.8% drop in project grants, due mainly to slower project implementation on account of the impact of the pandemic”.

Governor Saidy reiterated that government expenditure and net leading decreased during the review period while adding that expenditure and net lending in the first half of 2021 decreased slightly by 1.0% to D11.1 billion (11.*% of GDP) attributed to a decline in recurrent expenditure by 6.9%.