Given Senegal is Gambia’s third-largest trading partner, according to the International Trade Center, and is responsible for approximately 15-20% of its remittances, the greater question that beseeches us is how does this change impact The Gambia’s financial future?

Promise of Radical Change

Economically, the Pastef party, also known as the Patriotic Salvation Movement, campaigned on three central themes of self-economic determination: currency reform; renegotiation of Senegal’s oil and gas contracts with international firms and promotion of national companies; and decoupling from France.

Although Candidate Faye sought to use this agenda to capitalize on the youth’s disaffection with the Sall administration, President Faye seems unlikely to be willing to alienate key economic partners, such as oil majors and the International Monetary Fund (IMF).

These alliances are crucial for Senegal's financial credibility, economic resilience, and the realization of President Faye's ambitious development goals. Notably, Senegal currently benefits from substantial IMF support of around $1.8 billion, alongside invaluable technical assistance and structural relief, underscoring the importance of maintaining these partnerships for sustained progress.

Upside of Measured Approach

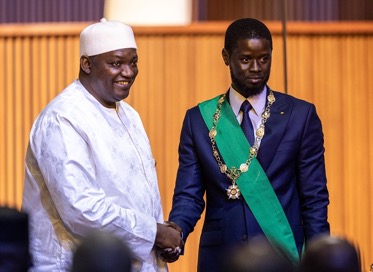

The initial concerns about potential radical economic reforms have been adeptly mitigated by strategic cabinet appointments. President Faye and his Prime Minister, Ousmane Sonko, have chosen experienced figures for key economic roles, signalling a commitment to stability and growth after an election campaign promising significant change.

Mr. Cheikh Diba, with a background in tax administration, assumes the pivotal role of finance minister, while Mr. Abdourahamane Sarr, a seasoned economist from the IMF, steps in as the economy minister. These appointments reassure the IMF of the country’s commitment to it structural reform and fiscal consolidation agenda. Furthermore, it’s poised to inspire confidence among global investors, reinforcing Senegal's reputation as a favourable investment destination, as seen during Macky Sall's tenure.

The positive market response to the election outcomes is evident in the decline of yields on Senegal’s $4 billion international bond complex, indicating greater investor confidence in the nation's economic prospects. Fitch Ratings, an international credit rating agency, has also said that “the return to political and social stability puts Senegal back on track to meet the IMF’s expectation of 8.3% GDP growth in 2024 (2023: 4.2%)”.

That said, others remain less sanguine despite these initial appointments given Faye’s campaign rhetoric and its perceived electoral mandate. S&P, a global credit rating agency, has signalled caution as “the new government has yet to communicate many of its key fiscal and economic policy proposals, which could affect Senegal’s creditworthiness.”

High Tide Lifts All Boats

Senegal has become an economic harbinger for the sub-region, so a stable and progressive Senegal yields positive externalities for The Gambia.

Besides the obvious benefits of increased cross-border commerce, remittances and FDI, Senegal’s upward trajectory to middle-income status presents The Gambia with a less obvious gift – increased international trade flow.

According to the International Trade Center (ITC), Senegal is set to face tariff changes in the next few years, as the country ‘graduates’ from its World Trade Organization (WTO) least developed country status, a sign of their economies stabilizing and growing.

Least developed countries (LDCs) are low-income countries that face significant obstacles to sustainable development. These countries receive special support measures, such as preferential market access, special treatment under World Trade Organization rules, technical assistance, and capacity building. As these countries grow and develop, they move out of this category and stop receiving these support measures, a process known as ‘graduation’.

The Committee for Development Policy – a body of the United Nations Economic and Social Council – reviews the list of least developed countries every three years to determine which meet the graduation criteria. If countries meet graduation criteria twice in a row – as is the case for Cambodia, Djibouti, and Senegal, following their second review in March 2024 – they become eligible for graduation.

As a consequence of Senegal’s graduation, more than a quarter (28%) of Senegal’s exports could become more expensive in India, the EU, and China. Senegal’s chemicals, seafood, and vegetal products will be among those sectors most affected, as the tariffs that will be charged on these products will increase in some markets.

This prospectively creates tremendous opportunities for The Gambia – which still qualifies for the LDC preferential trading policies and has existing trading relationships with these countries – as it ramps up its production and processing capacity in the agriculture and aquaculture sectors.

Key Takeaways for The Gambia

The aftermath of Senegal's election presents a roadmap with opportunities for The Gambia. President Faye's strategic moves and Senegal's economic stability hint at fertile ground for regional collaboration and economic progress.

The positive market response and Senegal's anticipated GDP growth signal potential benefits for The Gambia through increased cross-border commerce, remittances, and foreign direct investment.

Additionally, as Senegal graduates from its LDC status, The Gambia prospectively stands to capitalize on new trading opportunities, especially in sectors like agriculture and aquaculture where it's currently establishing a competitive edge and continues to benefit from preferential trading policies. This shift presents The Gambia with a chance to expand its market presence and enhance its economic resilience, aligning with broader regional development objectives.

The only question that remains is whether The Gambia will be prepared to fully capitalize on the prospective windfalls from Senegal’s high tide or will it miss the boat.