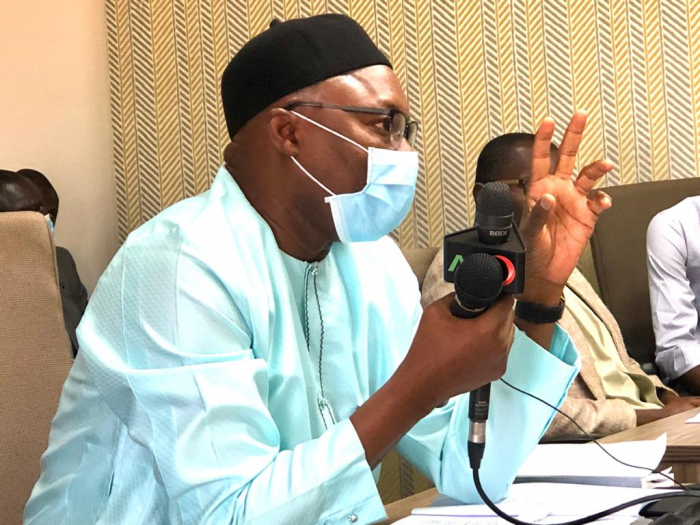

Minister Njie was responding to concerns and issues raised by lawmakers at parliament during the fifth legislative session on last Monday.

“I think we will have to come together with the National Assembly to see what we can do because it does not take a rocket scientist to see what is happening,” he said.

He said the transaction cost has increased inflation with no justification where one buys a commodity in the morning and returns in the evening to buy the same commodity and finds out that its price has increased.

“We are tempted but we do not want to go price-control. But if it takes government to go and import and compete then we will do it,” he added.

“The local input is also important if government is subsidising us with 90 percent because it has the responsibility to come with the 10 percent that will come from local funds,” he further said.

“If you check the records, he opined, 3, 000 is still on the low side for the lower income people.

“We’re hoping that by the time you leave we may be or even go beyond that.”

On the skyrocketing prices of commodities, the Minister said: “In all fairness I think the only increase that I remember coming to the National Assembly, the increases were only on alcohol and tobacco. All the others, we have not increased.”

“We are still battling to see exactly what is happening. As I am talking to you, 20 percent of the CIF prices are taken off from the invoices. What it needs now is both of us. We need to have a panel, where we can go on a campaign to ask the business what is happening, what is the justification.”

He told NAMs that for four years, there has not been increment in tax apart from alcohol and tobacco. “We have never increased anything. Yes, there are other issues that they are raising with the cost of trade, the delays and all those things and I think those things are secondary. But the bottom-line is, the rate at which they are increasing prices is not justified,” he added

“But we don’t want to go that path. But if that is what it will take to protect the lives and livelihoods of Gambians, we will do it. I think we have been talking in a democratic system, we cannot force them, we don’t want to go to the price-control, but we will do and take whatever it takes to make sure that people are protected.”

He added that “the duty has vitally gone down in principle because with the invoice that is coming, 20 percent is off. We were about to replace it, to come back. Rice, I have reported here that we have lost millions of dalasis, but yet it is going up, and the moment you move against them it is considered a prerogative measure.”

He urged the Assembly to work together with government to put pressure on importers and mega business leading to this price-hike, saying that Ramadan is almost here and that vulnerable and voiceless people must be protected. He told NAMs that they have to make sure as a government and the National Assembly have the responsibility to come together to see where they work with the Gambia Chamber of Commerce; not to force them but to reveal to the public that there are no increases in taxes.

“They can talk about other external factors but as far as we are concerned as a government, it is our responsibility and we are working together with the Ministry of Trade and we will invite the chamber of commerce to make sure as one people as one government we will try to combat that,” the Finance Minister concluded.