The authentication exercise, carried out at a national validation ceremony was convened with a shared commitment to building a modern, fair and efficient tax system for The Gambia.

The 2025 Taxpayer Charter aims to serve as a strong framework for cooperation, compliance, and trust between taxpayers and the Authority.

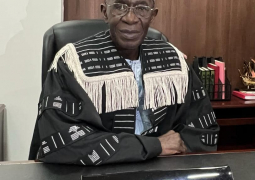

CG Darboe underscored that the Taxpayer Charter is much more than a document, adding that it is a social contract and a public declaration of their commitment to taxpayers, which also serves as a bridge of trust between the revenue authority and the citizens served.

According to him, the Charter clearly outlines taxpayers’ rights and obligations which set the standards of service taxpayers can expect from tax administrators, and provides clear avenues for redress when those standards are not met.

“Our first charter was a significant step forward, but the world does not stand still. The economic landscape evolves, technology advances, and with experience comes the wisdom to improve,” he said.

He advanced that the second edition is the product of that evolution, which reflects the lessons they have learned, the feedback they have received and their aspiration to align with international best practices in tax administration. This, he said, aims to be clearer, more accessible, and more comprehensive in defining their mutual relationship.

“We are transitioning from a traditional focus on enforcement to a more holistic approach centred on service delivery and fostering voluntary compliance,” he stated. “We believe that a well-informed taxpayer, who understands their rights and trusts the fairness of the system, is more likely to comply willingly.”

The Charter is the cornerstone of that belief, he said, adding that it is the promise of professionalism, transparency, confidentiality, and impartiality in all their dealings, as “a promise is only as strong as the conviction behind it”.

However, as he spelt out, the document could not be perfected in isolation within the walls of GRA; for it to be truly effective and representative, it must be shaped by the very people it is designed to serve.