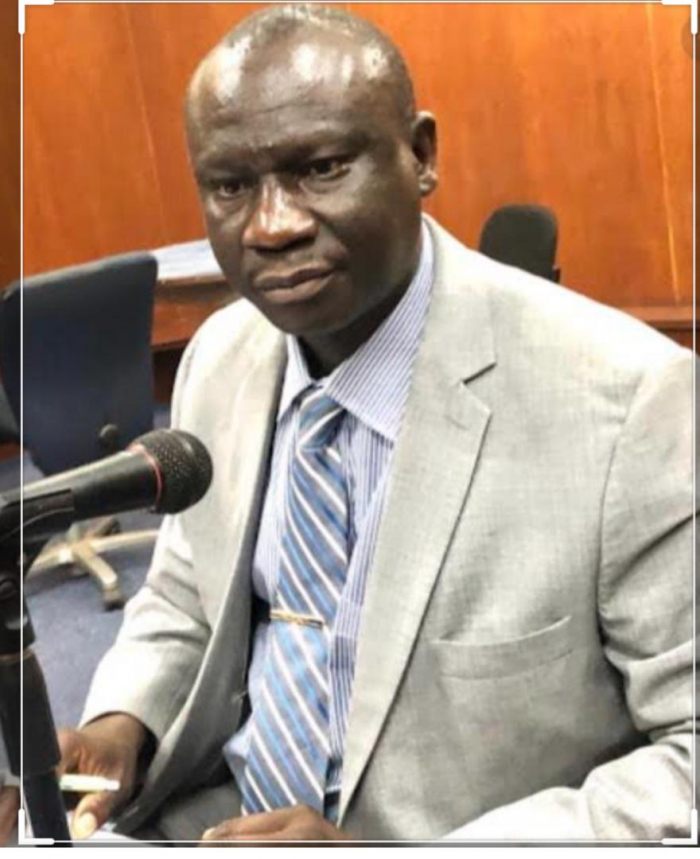

Speaking with the press, the newly appointed governor of the Central Bank, Buah Saidy enlightened the media that in the real sector development, the Gambia Bureau of Statistics (GBoS) has estimated real Growth Domestic Product for 2019 at 6.2 per cent, lower than 7.0 per cent in 2018.

He said growth was supported largely by the increase in the services sector, construction, as well as improved business sentiments.

The Central Bank’s Composite Index of Economic Activity (CIEA), which is a statistical measure of aggregate economic activity, shows a marked slowdown in economic activity in the third quarter of 2020, due mainly to the restrictions that were imposed to curb the spread of the coronavirus, Governor Saidy explained.

When it comes to the External Sector Developments, he said the preliminary balance of payments estimates for the first nine months of 2020 indicated that the current account balance worsened to a deficit of US$118.39 million (6.53 per cent of GDP) from a deficit of US$35.87 million (2.03 per cent of GDP) in the corresponding period of 2019. “This reflects a wider trade deficit and a decline in the service account balance.”

“From January to September 2020, imports amounted to US$470.47 million, higher than US$406.81 million during the same period in 2019. Exports decreased to US$58.12 million in the three quarters of 2020 from US$103.34 million in the corresponding period of 2019.”

The CBG Governor further explained the foreign exchange market development, with the volume of transactions in the foreign exchange market increasing to US$2.14 billion in the 12-months to end-October 2020, from US$2.2 billion in the corresponding period of the previous year.

Furthermore, from January to November 2020, the dalasi depreciated against the US dollar by 1.4 per cent, Euro by 6.3 per cent and pound sterling by 1.1 per cent.

The preliminary estimate of government fiscal operations indicated that overall deficit including grants improved from D2.3 billion in the first nine months of 2019 to a deficit of D2.2 billion in the first nine months of 2020.

“The budget deficit excluding grants worsened to a deficit of D6.1 billion in the first nine months of 2020 compared to D5.5 billion in the same period in 2019.”

On the he domestic debt developments, the outstanding domestic debt stock increased to D34.8 billion (35.3 per cent of the GDP) as at end-November 2020 from D33.1 billion (35.3 per cent of the GDP) as at end-December 2019. “The stock of Treasury and Sukuk Al Salaam bills increased by 8.90 per cent to D20.2 billion as at end-November 2020.”

Other economic and financial developments that were deliberated by the committee included the monetary developments in which money supply (M2) growth moderated to 21.8 per cent at end-September 2020 from 21.9 per cent as at end-September 2019.

“The price developments in which inflation remained largely subdued due to weak domestic demand, moderate global oil prices and stable exchange rate.”

Governor Saidy said the committee observed that the economic activity in The Gambia remains weak reflecting the effects of the pandemic. “A quicker recovery is anticipated in 2021,” he added.

He concluded that inflation in The Gambia continues to be stable. “The recent surge in inflation is judged to be temporal and would return close to the medium-term objective of 5 per cent in the near-term.”

He said the committee decided to maintain the policy rate at 10 per cent, maintain the required reserve at 13 per cent and maintain the interest rate on the standing deposit facility at 2.5 per cent and the standing lending facility at 11.0 per cent.

Read Other Articles In Headlines

Voice journalist granted bail, ordered to report at Police headquarters today

Sep 30, 2024, 10:54 AM

NA Trade Committee recommends Gambia and Senegal interconnect customs IT system

Sep 13, 2024, 10:28 AM