Bank officials from the West African Institute for Financial and Economic Management (WAIFEM) member countries are taking part in a five-day regional training course on the rudiments of interest-free (Islamic) banking at the Paradise Suites Hotel.

Organised by WAIFEM, the training session, among others, seeks to provide a broad understanding of the rudiments of Islamic banking to participants, and to also provide clarity on the Sharia requirements and the avoidance of Riba in modern day banking business.

The training course will, among others, discuss issues such as Fundamentals of Islam and introduction of Islamic thought; concept and overview of Islamic Finance; Legal and Institutional Framework, and development and challenges in Islamic Banking.

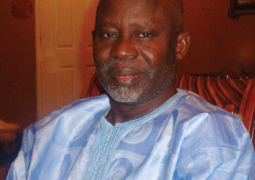

Speaking at the opening ceremony, Professor Akpan H. Ekpo, Director General of WAIFEM, said the institute was established in July 1996 by the Central Banks of The Gambia,

According to him, modern day Islamic banking started over three decades ago, with the establishment of the Islamic Bank of

“Islamic banking or non-interest banking is a banking model which is based on a profit and loss sharing system. It rests on the Islamic doctrine of ‘universal permissibility’ in business dealings, which states that everything is permissible unless it is clearly prohibited,” he stated.

He noted that in the conventional banking environment, it is a fact that borrowers are at times rendered miserable and frustrated, leading to failure as a result of overbearing interest rates.

“The irony is that while lending rates are always in an upward trajectory, deposit rates are pitiably low,” Professor Ekpo stated.

In his keynote address, Amadou Colley, Governor of the Central Bank of The Gambia, said Islamic banking as a variant of interest-free banking is a system of banking that is bound by Sharia (Islamic Law) and prohibits the taking or payment of interest.

Governor Colley told participants that it is very evident that there has been significant growth in Islamic financial services, in recent years, and there is every reason to expect that this growth will continue at a rapid pace.

“Clearly, there is expanding demand for these products, and a closely associated desire on the part of banks, including non-Islamic banks, to provide Islamic financial services,” Colley added.

According to the Central Bank Governor, from 2007 through 2009, Islamic banks’ assets grew, on average, faster than conventional banks’ assets in major markets.

He stated that this relatively higher rate of growth, along with the tendency to avoid excessive leverage and risk-taking have given some consumers, even non-Muslims, a new appreciation of the sector.

He noted that although the elements that are usually emphasized at forums like these are differences between Islamic and conventional banking, there are some fundamental principles that apply equally to both.

Read Other Articles In Article (Archive)

More than 60% of NIAs ‘illiterate’

Jun 8, 2017, 10:38 AM